In response to the EU Commission's proposal for a directive to harmonse specific elements of insolvency law on 7 December 2022, this article explores avoidance actions, one of the Directive Proposal’s key aspects, and the way avoidance actions are regulated in Serbia and Montenegro as EU candidate countries.

In the context of insolvency proceedings, avoidance actions involve the annulment of transactions undertaken by the insolvent debtor before the initiation of insolvency proceedings.

Avoidance actions in Serbia

For RSLs who are routinely contracting with housebuilders for golden brick delivery of affordable housing across multiple phases, we discuss the four key actions that can help if the housebuilder becomes insolvent.

1. Pre-Insolvency – Financial Distress Provisions and Due Diligence

Comme nous l’avions prédit dans nos numéros précédents de L’Actualité en insolvabilité, l’augmentation attendue du nombre de dossiers d’insolvabilité des entreprises s’est matérialisée en 2023. Dans ce numéro de L’Actualité en insolvabilité, nous exposons en détail les conclusions suivantes tirées de nos données : – Le nombre de dossiers d’insolvabilité d’entreprises a atteint son plus haut niveau en 2023 depuis 2019, soit une augmentation de 41,4 % comparativement au nombre de dossiers d’insolvabilité d’entreprises en 2020 et une augmentation de 30,7 % comparativement à celui de 2019.

(1)分割前の債権債務(1)分割前の債権債務第1 はじめに

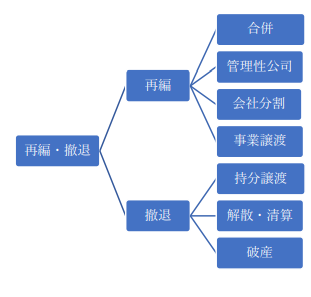

中国子会社が複数の事業を営んでおり一部の事業を 切り離したいような場合、優良事業と不良事業とに分 ける方法がある。具体的には①会社分割、②事業譲渡 といった方法がある。これらの方法は中国子会社を再 編する方法として有効である。

第2 会社分割

1 会社分割とは

After a long and arduous litigation Jet Airways’ insolvency woes have finally reached a conclusion. At least that is the hope unless the litigation is taken to the Supreme Court. Having said that, the National Company Law Appellate Tribunal (“NCLAT”) in its decision dated 12.03.2024, in Company Appeal (AT) (Insolvency) No. 129 & 130 of 2023, approved the transfer of ownership of Jet Airways to the Jalan Kalrock Consortium (“JKC”). This hopefully leads the path for the commencement of a new era for the airline.

DoCA’s: Discriminating between Creditors -Is it for a Proper Purpose

Canstruct Pty Limited v Project Sea Dragon Pty Limited (No. 4) [2024] FCA 112 ("Canstruct")

The Supreme Court’s landmark decision in Sequana1leaves many unanswered questions, and finding a common thread between the four quite separate judgments has proved challenging for practitioners and directors alike. The recent decision in Hunt v.

In Short

The Situation: For the first time ever, a court in France has examined the compatibility of the statutory netting safe harbor with the French Constitution. The French High Court of Justice (Cour de cassation) addressed the preliminary question of constitutionality in the context of an insolvency proceeding and handed down its decision on March 6, 2024.

The new Spanish Bankruptcy Law in September 2022 (TRLC)1 ushered in perhaps the most radical changes to the domestic restructuring market in any EU Member State that has so far implemented the EU Directive on Preventive Restructuring.2 For the first time, following satisfaction of certain conditions, the disenfranchisemen

On March 11, 2024, Judge Colm F.