The judgment of Chief ICC Judge Briggs in Becker (A Bankrupt) v Ford & Ors [2024] EWHC 1001 (Ch) provides a useful summary of the matters to which the court should have regard when considering an application to lift the suspension of a bankrupt’s discharge.

The rescue of a company in business rescue ultimately depends on the implementation of a viable business rescue plan which has received the support of 75% of the creditors of the company. A recent business rescue case of Wescoal Mining (Pty) Ltd Another v Mkhombo NO1 and Other has potentially wide-ranging implications for creditors after business rescue has commenced.

Whilst most people would hope it could never happen to them, in our experience it often can. As such it pays to be prepared.

March, 2024 For Private Circulation - Educational & Informational Purpose Only A BRIEFING ON LEGAL MATTERS OF CURRENT INTEREST KEY HIGHLIGHTS * NCLT: Corporate insolvency resolution process cannot be initiated under Section 7 of IBC based on transfer agreement for purchase of debentures from financial creditors. ⁎ NCLAT: Security for refund of advance amount cannot change the nature of transaction for supply of goods into financial debt.

Die Marktbedingungen werden zunehmen schwieriger, und die Restrukturierungswelle hat Deutschland erreicht. Der Strukturwandel stellt viele deutsche Unternehmen immer wieder vor neue Herausforderungen und erfordert es, Prozesse und Strategien flexibel anzupassen. Parallel erhöht die Zeitenwende im Finanzierungsumfeld den Druck der Geldgeber: Geschäftsmodelle müssen krisenfest gestalten sein, dabei sollen Kosten gesenkt werden - und gleichzeitig ist es erforderlich, sich langfristig zukunftsfähig aufzustellen.

Market conditions are growing increasingly difficult as the restructuring wave reaches Germany. Many German companies are struggling as they are faced with the challenge of structural changes and a necessity to adapt their processes and strategies. At the same time, significant change in the financing sector is adding to the pressure on borrowers: business models must be crisis-proof and costs reduced – while at the same time it is necessary to position oneself for the future.

(1)分割前の債権債務(1)分割前の債権債務第1 はじめに

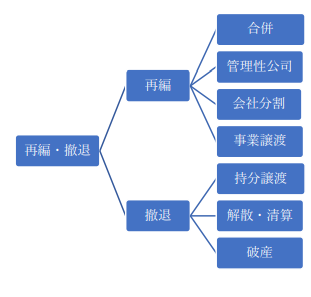

中国子会社が複数の事業を営んでおり一部の事業を 切り離したいような場合、優良事業と不良事業とに分 ける方法がある。具体的には①会社分割、②事業譲渡 といった方法がある。これらの方法は中国子会社を再 編する方法として有効である。

第2 会社分割

1 会社分割とは

A Cayman Islands scheme of arrangement is a court approved compromise or arrangement between a company and its creditors or shareholders (or classes thereof). A scheme of arrangement is frequently used to implement a financial restructuring by varying or cramming in the rights of the relevant creditors and/or shareholders of a company but may also be used to complete corporate transactions such as a group restructuring or reorganisation, acquisitions, mergers and take-private transactions.

While there is a statutory requirement to register most forms of security granted by limited companies incorporated in the UK at Companies House, it is worth remembering that there is no statutory requirement for the holder of registered security to inform Companies House if, e.g., the debt secured by a registered charge has been satisfied.

Summary

In the first appeal of a restructuring plan under Part 26A Companies Act 2006, the English Court of Appeal unanimously set aside the first instance decision sanctioning the plan proposed by AGPS BondCo PLC, part of the Adler real estate group1.