2024 Any questions?

IE CA 3 Holdings Ltd and IE CA 4 Holdings Ltd (Companies) were two Canadian registered companies whose directors were located outside of Canada. The Companies’ parent company, Iris Energy Limited (Iris), was listed on NASDAQ and had its registered office in Melbourne and principal place of business in Sydney, with three of its six directors located in New South Wales.

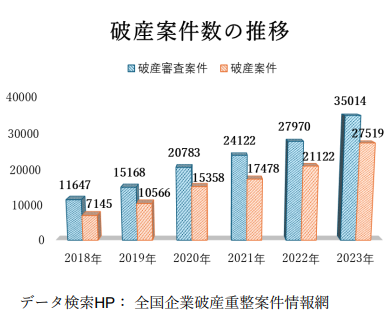

1 増加する破産案件

中国の最高人民法院は、2016年8月より「全国企業破産 重整案件情報網」というHPにおいて、全国の破産案件に 関する情報を公開しているが、当該HPにて1年ごとに破 産審査案件数及び破産案件数を検索した結果は以下の表 のとおりである。これを見ると、中国の破産案件数は近 時増加の一途をたどっていることがはっきりと見て取れ る。

http://pccz.court.gov.cn/pcajxxw/index/xxwsy

2 中国の倒産制度

Il 27 settembre 2024 è stato pubblicato in Gazzetta Ufficiale il D.Lgs. 13 settembre 2024, n. 136 (“Correttivo-ter”), è il terzo – e attualmente ultimo – Decreto Correttivo al Codice della Crisi d’Impresa e dell’Insolvenza. Il novello decreto correttivo ha apportato modificazioni sostanziali a numerosi istituti del Codice della Crisi.

On September 27, 2024, Legislative Decree No. 136 of September 13, 2024 (“Correttivo-ter”) was published in the Official Gazette. This represents the third—and currently final—Corrective Decree to the Business Crisis and Insolvency Code. The new corrective decree has introduced substantial amendments to several provisions of the Crisis Code. Beyond minor stylistic and detailed adjustments, the Correttivo-ter both incorporates certain practices or clarifies interpretive uncertainties and introduces some highly anticipated innovations for practitioners.

Deeds of Company Arrangement – Insured Claims

Destination Brisbane Consortium Integrated Resort Operations Pty Ltd as Trustee v PCA (Qld) Pty Ltd (subject to a Deed of Company Arrangement) [2024] QSC 178 ("Destination Brisbane")

In Destination Brisbane two questions, which concerned the entitlements of insured creditors under a DoCA, arose for consideration in the context of an application for judicial advice:

Two recent Supreme Court of Canada decisions demonstrate that the corporate attribution doctrine is not a one-size-fits-all approach.

On September 27, 2024, Legislative Decree No. 136 of September 13, 2024 (“Correttivo-ter”) was published in the Official Gazette. This is the third—and currently final—Corrective Decree to the Code of Business Crisis and Insolvency.

The new corrective decree has made substantial changes to all aspects of the Crisis Code. Beyond numerous stylistic and detailed adjustments, the Correttivo-ter both incorporates certain practices or resolves interpretative uncertainties and introduces several long-awaited innovations for practitioners.

The provisions governing the winding-up of co-operatives are reflected in the Co-operatives Act No. 14 of 2005 and its regulations.

How are co-operatives wound up?

Introduction

In this case the Court applied traditional constructive trust principles to disputed facts in order to determine whether a specific property came within the estate of a bankrupt. It will be of interest to practitioners advising in the area of challenged transfers in the context of insolvency.

The Trustees in the bankruptcy of Shaun Collins made an application pursuant to s.339 Insolvency Act 1986, to challenge a disposition of land. The land in question was a flat and the disposition was a 2021 transfer of a flat in London.