Welcome to our latest edition of FMCG Express! 2020 continues to be an eventful year, although we are cautiously optimistic that we may be turning a corner in Australia. While COVID-19 continues to cast a shadow over our lives, our cities are starting to show green shoots of life, which is welcome news. Our thoughts are with our families, clients, associates, friends and colleagues in countries where numbers are at very concerning levels. In this edition, we have some useful COVID-19 reading. Siobhan Mulcahy considers the ongoing issues of JobKeeper with casual workers.

In the latest edition of Going concerns, Stephenson Harwood's Asia restructuring and insolvency team touch on key changes in Singapore brought about by the recent Singapore Insolvency, Restructuring and Dissolution Act 2018 (and where applicable, the impact on the shipping industry), and the positions in Singapore and Hong Kong on winding up petitions vs arbitration clauses.

Content

Get to know the Insolvency, Restructuring and Dissolution Act 2018 ("IRDA") Winding up petitions vs arbitration clauses (SG) The prima facie standard of review prevails

In a judgment delivered on 14 October 2020, the High Court, in refusing to appoint an examiner to New Look Retailers Ireland Limited (New Look Ireland) ruled that it was "entirely premature to consider the appointment of an examiner". New Look Ireland trades under the brand name "New Look" and operates across 27 stores in Ireland.

Already at the beginning of the Corona crisis in March 2020, the legislator decided on various insolvency law measures to mitigate the consequences of the Corona pandemic for the Austrian economy. Since the Corona Pandemic still has far-reaching economic consequences for businesses and entrepreneurs, including even potential insolvency, the legislator has now adopted further measures in the area of insolvency law.

When does insolvency occur and what is to be done?

Due to the ongoing COVID pandemic and associated economic downturn, the number of companies facing the prospect of insolvency, or being struck off the Register of Companies, is increasing daily. Whilst the rules on striking off have been relaxed by Companies House where late delivery of accounts etc has been caused by COVID, these are only temporary measures. Indeed, the compulsory striking off process has recently resumed for companies that Companies House don’t consider are currently operating, so it may be that normal practice isn’t far away.

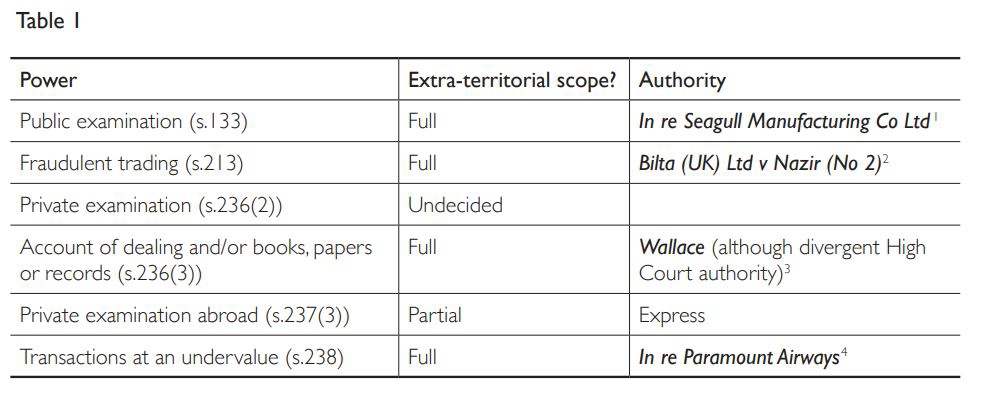

This article was first published in International Corporate Rescue.

In an important affirmation of the rights and duties of a creditors’ committee, Bankruptcy Judge David T. Thuma of the United States Bankruptcy Court for the District of New Mexico has confirmed that a bankruptcy court may confer derivative standing on a committee to assert estate claims if a debtor in possession declines to assert them.[1]

INTRODUCTION

Recently, the Hon’ble National Company Law Appellate Tribunal has passed an order reiterating that once a resolution plan is approved by the Committee of Creditors (CoC), the successful resolution applicant cannot be permitted to be withdraw its plan.

RELEVANT FACTS

In Caron and Seidlitz v Jahani and McInerney in their capacity as liquidators of Courtenay House Pty Ltd (in liq) & Courtenay House Capital Trading Group Pty Ltd (in liq) (No 2),[1] the New South Wales Court of Appeal was faced with what it described as the ‘classic insolvency conundrum’: how to distribute funds to investors as equally and as fairly as possible where the funds have

In a judgment delivered on 14 October 2020, Mr. Justice McDonald declined to confirm the appointment of an examiner to New Look Retailers (Ireland) Ltd (New Look).

Facts