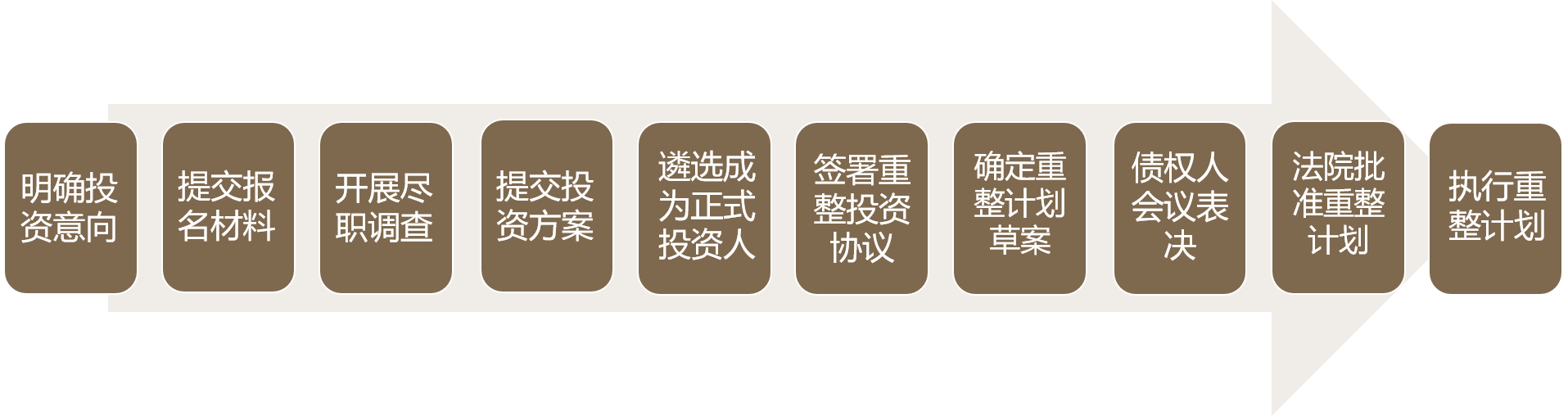

目前对于陷入困境但仍具备重整价值及重整可行性的企业而言,破产重整是其实现风险出清和企业重生的重要方式。在破产重整中,投资人参与的主要方式包括股权投资、资产投资和债权投资等,其中股权投资为较为重要的投资方式(其基本流程如下图),本文将结合实践,从投资人视角,浅析破产重整中股权投资的机遇和风险防范,以期为投资人参与重整投资提供帮助。

图1:破产重整中股权投资基本流程图

一、重整投资的机遇

现阶段,重整投资作为“新一轮招商引资”处于重要机遇期。以上市公司重整为例,2023年7月底的数据显示其中超90%的产业投资人和财务投资人账面呈现浮盈[1];2024年以来,截至11月,有44家上市公司被申请重整及预重整,较前一年同期增加超四成[2]。由此可见,破产重整蕴含着较多投资机会,其在目前政策环境、价值发掘、成本控制和业务整合等方面均展现出投资“机遇”。

It is not uncommon for contractors, in several industry sectors, to contract with a special purpose vehicle (SPV), whose day-to-day management is effectively controlled by a parent company, and the SPV has with little to no assets beyond cash flow provided by its parent. In this article we look at what a claimant could do outside of the traditional insolvency process in circumstances where the SPV goes into a form of external administration such as administration or liquidation and there are no assets available to the external administrators.

在当前的投融资环境下,国资背景的投资方常常承担着地方政府的返投任务,对被投企业的注册地点存在特定诉求,因此,若被投企业未注册在此类投资方期待的特定地区,则投资方可能会要求被投企业迁址以实现当地的招商引资。市场上已出现部分项目的投资方以此作为投资交割的前提条件。

优质企业无疑都是各地的“心头肉”,能为当地带来税收效益、工作岗位等。因此,企业的迁出之路可能面临迁出地政府“不放手”、迁出和迁入程序衔接不顺畅等一系列疑难问题,可能拉长迁址进度,甚至实质上无法最终完成迁址。

为协助企业顺利实现“迁址”目的,我们在相关交易中对企业迁址的命题进行重新思考和思路转换。事实上,除了直接变更注册地址,企业也可考虑通过股权重组进行股权结构的调整,以满足投资方对于变更融资主体及后续上市主体所在地的需求。但此等“重组式迁址”也并非一路坦途,如有不慎,同样可能面临法律和税务的障碍和风险,因此需要提前对这类重组交易进行审慎考量和规划。

一、直接迁址的障碍和难点

Frequently a debtor’s assets are sold out of bankruptcy “free and clear” of liens and claims under §363(f). While the Bankruptcy Code imposes limits on this ability to sell assets, it does allow the sale free and clear if “such interest is in bona fide dispute” or if the price is high enough or the holder of the adverse interest “could be compelled ... to accept a money satisfaction of such interest” or if nonbankruptcy law permits such sale free and clear of such interest.

On February 5, 2016 the IRS released Chief Counsel Advice Memorandum Number 201606027 (the IRS Memo) concluding that “bad boy guarantees” may cause nonrecourse financing to become, for tax purposes, the sole recourse debt of the guarantor. This can dramatically affect the tax basis and at-risk investment of the borrowing entity’s partners or members. Non-recourse liability generally increases the tax basis and at-risk investment of all parties but recourse liability increases only that of the guarantor.

A long-honored concept in real property, that of “covenants running with the land,” is finding its way into the bankruptcy courts. If a covenant (a promise) runs with the land then it burdens or benefits particular real property and will be binding on the successor owner; if that covenant does not run with the land then it is personal and binds those who promised but does not impose itself on a successor owner.

We are often asked what to do if you have an operating agreement and your operator or one of the other working interest owners files for bankruptcy. The Bankruptcy Code allows the debtor to assume or reject the JOA (it is usually an executory contract).

On November 13, 2015, the Federal Deposit Insurance Corporation (FDIC) issued Financial Institution Letter 51-2015 (FIL-51-2015), FDIC Seeking Comment on Frequently Asked Questions Regarding Identifying, Accepting and Reporting Brokered Deposits. FIL-51-2015 seeks comments on the proposed updates to the existing FAQ document on brokered deposits, which was initially released in January of 2015 in FIL-2-2015, after additional comments and questions have been received by the FDIC since the initial issuance.

Under section 363 of the Bankruptcy Code, a debtor is permitted to sell substantially all of its assets outside of a plan of reorganization. Over the past two decades, courts have increasingly liberalized the standards under which 363 sales are approved. A recent decision from the United States Court of Appeals for the Third Circuit,

The Fifth Circuit recently dealt with the interplay of bankruptcy and oil and gas liens in the case of In Re: T.S.C. Seiber Services, L.C., decided November 3, 2014.