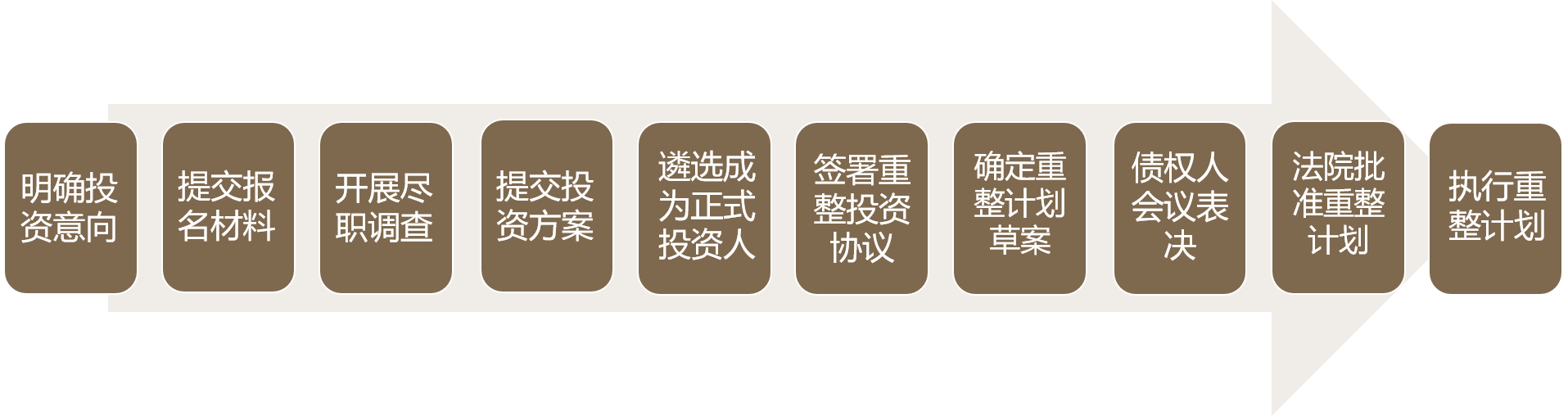

目前对于陷入困境但仍具备重整价值及重整可行性的企业而言,破产重整是其实现风险出清和企业重生的重要方式。在破产重整中,投资人参与的主要方式包括股权投资、资产投资和债权投资等,其中股权投资为较为重要的投资方式(其基本流程如下图),本文将结合实践,从投资人视角,浅析破产重整中股权投资的机遇和风险防范,以期为投资人参与重整投资提供帮助。

图1:破产重整中股权投资基本流程图

一、重整投资的机遇

现阶段,重整投资作为“新一轮招商引资”处于重要机遇期。以上市公司重整为例,2023年7月底的数据显示其中超90%的产业投资人和财务投资人账面呈现浮盈[1];2024年以来,截至11月,有44家上市公司被申请重整及预重整,较前一年同期增加超四成[2]。由此可见,破产重整蕴含着较多投资机会,其在目前政策环境、价值发掘、成本控制和业务整合等方面均展现出投资“机遇”。

It is not uncommon for contractors, in several industry sectors, to contract with a special purpose vehicle (SPV), whose day-to-day management is effectively controlled by a parent company, and the SPV has with little to no assets beyond cash flow provided by its parent. In this article we look at what a claimant could do outside of the traditional insolvency process in circumstances where the SPV goes into a form of external administration such as administration or liquidation and there are no assets available to the external administrators.

在当前的投融资环境下,国资背景的投资方常常承担着地方政府的返投任务,对被投企业的注册地点存在特定诉求,因此,若被投企业未注册在此类投资方期待的特定地区,则投资方可能会要求被投企业迁址以实现当地的招商引资。市场上已出现部分项目的投资方以此作为投资交割的前提条件。

优质企业无疑都是各地的“心头肉”,能为当地带来税收效益、工作岗位等。因此,企业的迁出之路可能面临迁出地政府“不放手”、迁出和迁入程序衔接不顺畅等一系列疑难问题,可能拉长迁址进度,甚至实质上无法最终完成迁址。

为协助企业顺利实现“迁址”目的,我们在相关交易中对企业迁址的命题进行重新思考和思路转换。事实上,除了直接变更注册地址,企业也可考虑通过股权重组进行股权结构的调整,以满足投资方对于变更融资主体及后续上市主体所在地的需求。但此等“重组式迁址”也并非一路坦途,如有不慎,同样可能面临法律和税务的障碍和风险,因此需要提前对这类重组交易进行审慎考量和规划。

一、直接迁址的障碍和难点

Two recent cases out of the Third Circuit and the Southern District of New York highlight some of the developing formulas US courts are using when engaging with foreign debtors. In a case out of the Third Circuit, Vertivv. Wayne Burt, the court expanded on factors to be considered when deciding whether international comity requires the dismissal of US civil claims that impact foreign insolvency proceedings.

Key Takeaways

Key Takeaways

When a majority of a company’s board approves a tender offer in good faith, can it still be avoided as an actually fraudulent transfer? Yes, says the Delaware Bankruptcy Court, holding that the fraudulent intent of a corporation’s CEO who was a board member and exercised control over the board can be imputed to the corporation, even if he was the sole actor with fraudulent intent.

Background

Key Takeaways

Recently, in In re Moon Group Inc., a bankruptcy court said no, but the district court, which has agreed to review the decision on an interlocutory appeal, seems far less sure.