In this article we will cover the notice requirements for an out of court administration appointment by a company or its directors, and look at the recent case of Re Tokenhouse VB Ltd (Formerly VAT Bridge 7 Ltd) [2020] EWHC 3171 (Ch).

The notice requirements

Being a director is not just about managing and controlling a business; it also involves taking on certain legal duties and obligations. Directors get the benefit of limited liability, but directors' duties impose certain obligations to ensure they act in the best interest of the company, its employees, shareholders – and in certain circumstances, its creditors too.

On 8 October 2020, the UK government published a report reviewing voluntary measures introduced in 2015 to improve the transparency of pre-pack sales in administration.

As part of the legislative changes brought about by the Finance Act 2020, the Treasury drafted the Insolvency Act 1986 (HMRC Debts: Priority on Insolvency) Regulations 2020 (the Regulations) and laid these before parliament on 14 September 2020. View a copy of the regulations.

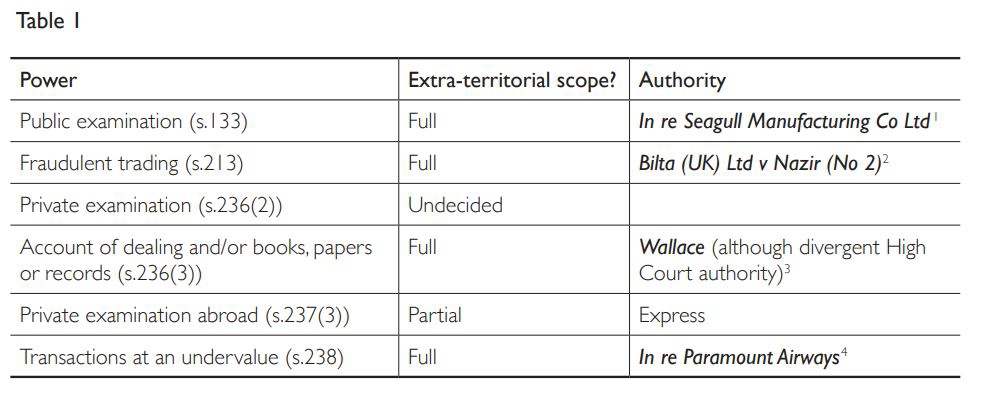

This article was first published in International Corporate Rescue.

What is a pre-pack?

Pre-pack is the term used to describe an arrangement whereby the sale of all or part of a company’s business and/or assets is negotiated and agreed before an insolvency practitioner (IP) is appointed, with the relevant documentation being signed and implemented, immediately or shortly, after the appointment is made.

Due to the ongoing COVID pandemic and associated economic downturn, the number of companies facing the prospect of insolvency, or being struck off the Register of Companies, is increasing daily. Whilst the rules on striking off have been relaxed by Companies House where late delivery of accounts etc has been caused by COVID, these are only temporary measures. Indeed, the compulsory striking off process has recently resumed for companies that Companies House don’t consider are currently operating, so it may be that normal practice isn’t far away.

Executive Summary

The Corporate Insolvency and Governance Act 2020 (“CIGA”), which came into force on 26 June 2020, introduced a series of new “debtor friendly” procedures and measures to give companies the breathing space and tools required to maximize their chance of survival. The main insolvency related reforms in CIGA (which incorporates both permanent and temporary changes to the UK’s laws) include:

1. New moratorium to give companies breathing space from their creditors

2. Prohibition on termination of contracts for the supply of goods and services by reason of insolvency

On 8 October 2020, the UK Government published draft regulations applying to sales in administration by way of a 'pre-pack' to a connected party purchaser.

UK pre-pack administrations

A pre-pack administration is where: